What Is Debt-Service Coverage Ratio?

Content

- What are the benefits of a higher DSCR for a commercial real estate loan?

- Commerical Real Estate Glossary

- Formula and Calculation of DSCR

- How can investors improve their DSCR to qualify for a commercial real estate loan?

- What are the advantages of a CMBS loan with a higher DSCR?

- Advantages and Disadvantages of DSCR

DSCR is also a more comprehensive analytical technical when assessing the long-term financial health of a company. Compared to interest coverage ratio, DSCR is a more conservative, broad calculation. DSCR is also an annualized ratio that often represents a moving 12-month period. Other financial ratios are usually a single snapshot of a company’s health; therefore, DSCR may be a more true representation of a company’s operations. DSCR, like other ratios, have value when calculated consistently over time. A company can calculate monthly DSCR to analyze its average trend over a period of time and project future ratios.

- Listing debt service as an expense shows how it adds in with other expenses and compared to the income your business will be getting each month.

- It is often used with the Debt Service Coverage Ratio because the DSCR provides a more accurate picture of a company’s ability to repay its debts.

- A tendency to lend to less-qualified borrowers can, in turn, affect the economy’s stability.

- For example, if your net operating income is $100,000 and your debts total $100,000, the ratio would be 1.

- The DSCR is 1.0 if a company has an annual net operating income equal to the required annual payments of interest and principal on all debt.

For example, a Debt Service Coverage Ratio that has a net operating income of $250,000 and a debt service of $200,000 has a debt-service coverage ratio of 1.25. Looking at it another way, this hypothetical business can pay 125% of its debts under its current operating circumstances, leaving it some wiggle room in case conditions change. Take the net operating income of your business and divide it by your total debt obligations such as business loans. For example, if your net operating income is $100,000 and your debts total $100,000, the ratio would be 1.

What are the benefits of a higher DSCR for a commercial real estate loan?

This metric assesses a company’s ability to meet its minimum principal and interest payments, including sinking fund payments, for a given period. To calculate DSCR, EBIT is divided by the total amount of principal and interest payments required for a given period to obtain net operating income. Because it takes into account principal payments in addition to interest, the DSCR is a slightly more robust indicator of a company’s financial fitness. The formula for the debt-service coverage ratio requires net operating income and the total debt servicing for the entity. Net operating income is a company’s revenue minus certain operating expenses , not including taxes and interest payments. It is often considered the equivalent of earnings before interest and tax . Having a high DSCR is beneficial for borrowers because it indicates that they have sufficient cash flow to cover their debt obligations.

To calculate your TDS ratio, add all of your monthly debts and divide that figure by your gross monthly income. It also does not consider a business’s ability to generate future income, which is essential for repaying debts over the long term. Other expenses a lender will typically deduct from the NOI calculation include tenant improvement and leasing commissions, which are required to attract tenants and achieve full or market-based occupancy.

Commerical Real Estate Glossary

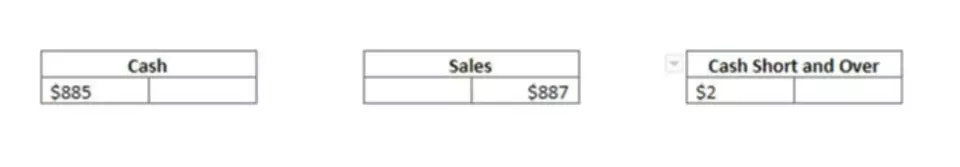

This article walked through the https://www.bookstime.com/ service coverage ratio step by step to clarify these calculations. In the above analysis, we included the business owner’s personal income and personal debt service. Assuming the owner was taking an abnormally high salary from the business, this would explain the low debt service coverage ratio when looking at the business alone, as in the previous example. In this new global debt service coverage calculation, we take this salary into account as cash flow, as well as all personal debt service and living expenses. A debt service coverage ratio of 1 means a property is generating enough income to make its loan payments, while DSCR of less than 1 means it is not.

Debt service refers to the money that is required to cover the payment of interest and principal on a loan or other debt for a particular time period. Theinterest coverage ratio indicates the number of times that a company’s operating profit will cover the interest it must pay on all debts for a given period.

Leave a Reply

Want to join the discussion?Feel free to contribute!